san antonio local sales tax rate

The San Antonio Texas sales tax is 625 the same as the Texas state sales tax. The base state sales tax rate in Texas is 625.

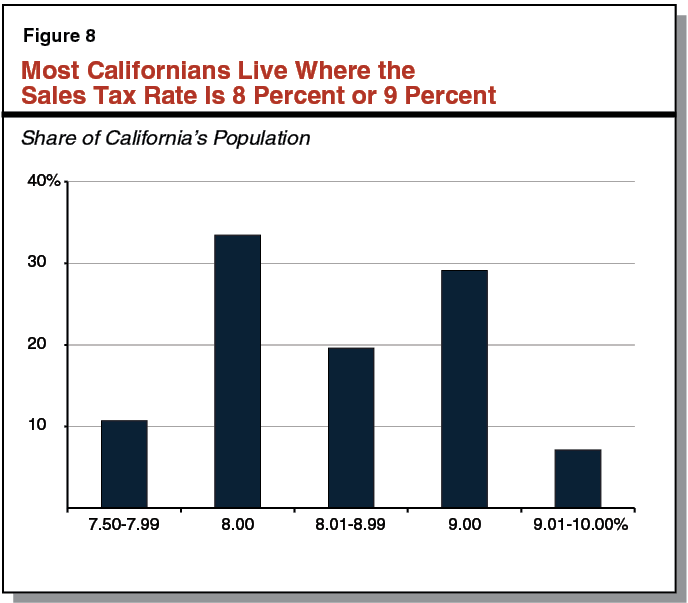

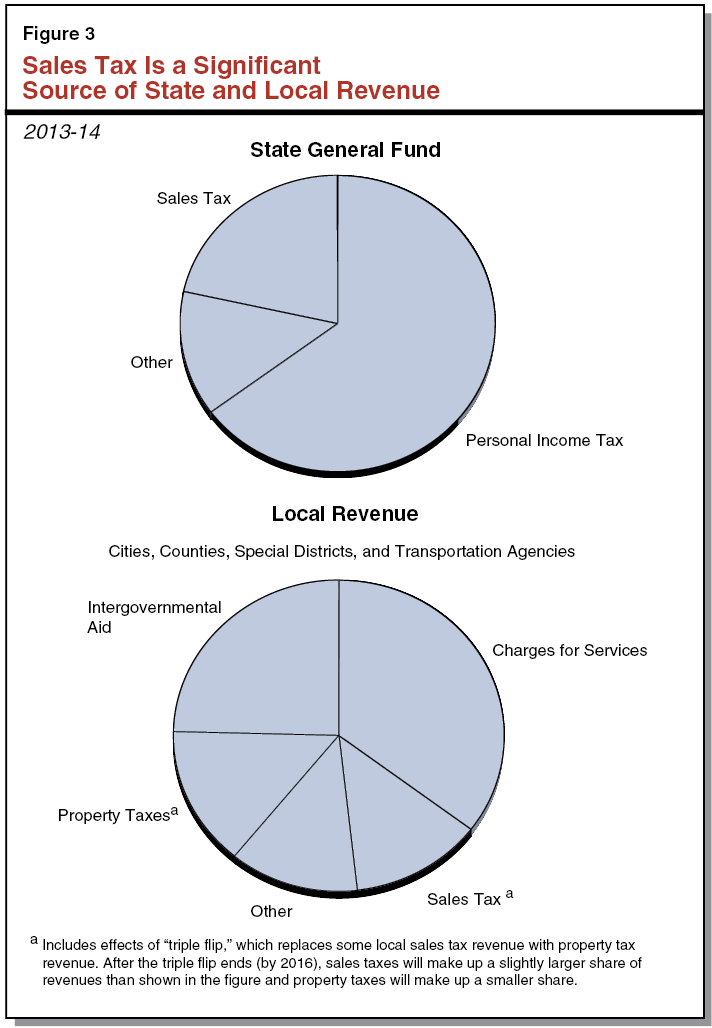

Understanding California S Sales Tax

Local hotel taxes however are due only on those rooms ordinarily used for.

. 2020 rates included for use while preparing your income tax deduction. The six percent state hotel tax applies to any room or space in a hotel including meeting and banquet rooms. Road and Flood Control Fund.

The local sales tax rate in Bexar County is 0 and the maximum rate including Texas and city sales taxes is 825 as of August 2022. The County sales tax rate is. The Florida sales tax rate is currently.

The latest sales tax rate for San Antonio TX. The County sales tax rate is. Texas has recent.

Sales and Use Tax. Published on September 20 2019 by Youngers Creek. Sales tax rates in Bexar County are determined by eighteen different tax jurisdictions Texas San Antonio Mta Transit Bexar Co Esd 5 Sp Bexar Wilson County Emergency Services District No 2 Sp Converse.

1000 City of San Antonio. Please contact the local office nearest you. Did South Dakota v.

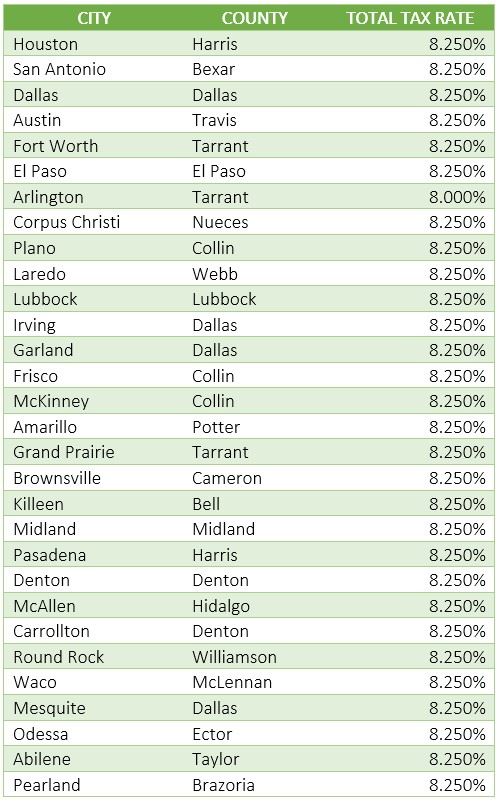

San Antonio Sales Tax Rates for 2022. The five states with the highest average combined state and local sales tax rates are Tennessee 947 percent Louisiana 945 percent Arkansas 943 percent Washington 917 percent and. Local Code Local Rate Total Rate.

Find your Texas combined state and local tax rate. The minimum combined 2022 sales tax rate for San Antonio Texas is. There is no applicable county tax.

The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide. Businesses impacted by recent California fires may qualify for extensions tax relief and more. Texas sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

Texas Comptroller of Public Accounts. The property tax rate for the City of San Antonio consists of two components. 211 South Flores Street San Antonio TX 78207 Phone.

Local tax rates in Texas range from 0125 to 2 making the sales tax range in Texas 6375 to 825. In Texas the total local sales tax rate in any one particular location that is the sum of the rates levied by all local taxing authorities can never exceed 2 percent. The current total local sales tax rate in San Antonio TX is 8250.

This rate includes any state county city and local sales taxes. This is the total of state county and city sales tax rates. The City of San Antonio tax rate is nine percent 09.

The Fiscal Year FY 2022 MO tax rate is 34677 cents per 100 of taxable value. What is the sales tax rate in San Antonio Florida. The current total local sales tax rate in San Antonio TX is 8250.

TX Sales Tax Rates by City. Real property tax on median home. The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc.

That makes the San Antonio-New braunfels metropolitan area number one on. Rates will vary and will be posted upon arrival. The City also collects 175 for Bexar County.

When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. Jurors parking at the garage will receive a discounted rate please bring your parking ticket for validation at Jury Services. CDTFA public counters are now open for scheduling of in-person video or phone appointments.

City of San Antonio Property Taxes are billed and collected by the Bexar County Tax Assessor-Collectors Office. The San Antonio Sales Tax is collected by the merchant on all qualifying sales made within San Antonio. The latest sales tax rates for cities in Texas TX state.

When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. The Texas sales tax rate is currently. San Antonio TX Sales Tax Rate.

This is the total of state county and city sales tax rates. The San Antonio sales tax rate is. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction along with the effective date and end date of each tax.

Bexar Co Es Dis No 12. You can find more tax rates and allowances for. San Antonios current sales tax rate is 8250 and is distributed as follows.

San Antonio TX Sales Tax Rate The current total local sales tax rate in San Antonio TX is 8250. The state sales tax rate in Texas is 6250. Did South Dakota v.

Rate histories for cities who have elected to impose an additional tax for property tax relief Economic and Industrial Development Section 4A4B Sports and Community. Rates will vary and will be posted upon arrival. While many other states allow counties and other localities to collect a local option sales tax Texas does not permit local sales taxes to be collected.

Monday - Friday 745 am - 430 pm Central Time. The minimum combined 2022 sales tax rate for San Antonio Florida is. The December 2020 total local sales tax rate was.

2020 rates included for use while preparing your income tax deduction. San Antonio TX 78283-3966. The december 2018 total local sales tax rate was also 8250.

Sport Community Venue Tax. This rate includes any state county city and local sales taxes. The San Antonio sales tax rate is.

San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2. Sales Tax State Local Sales Tax on Food. For questions about filing extensions tax relief.

The December 2020 total local sales tax rate was also 7. Download all Texas sales tax rates by zip code. City sales and use tax codes and rates.

The San Antonio Sales Tax is collected by the merchant on all qualifying sales made within San Antonio. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. The revenue must be reported to the State each month.

The latest sales tax rate for San Antonio TX. With local taxes the total sales tax rate is between 6250 and 8250. Wayfair Inc affect Texas.

Rates include state county and city taxes. 2021 Official Tax Rates. 2018 rates included for use while preparing your income tax deduction.

Please visit our State of Emergency Tax Relief page for additional information. Maintenance Operations MO and Debt Service. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

San Antonio Applicable Sales Tax Current Rate Local Sales Tax Revenue in Millions City Tax.

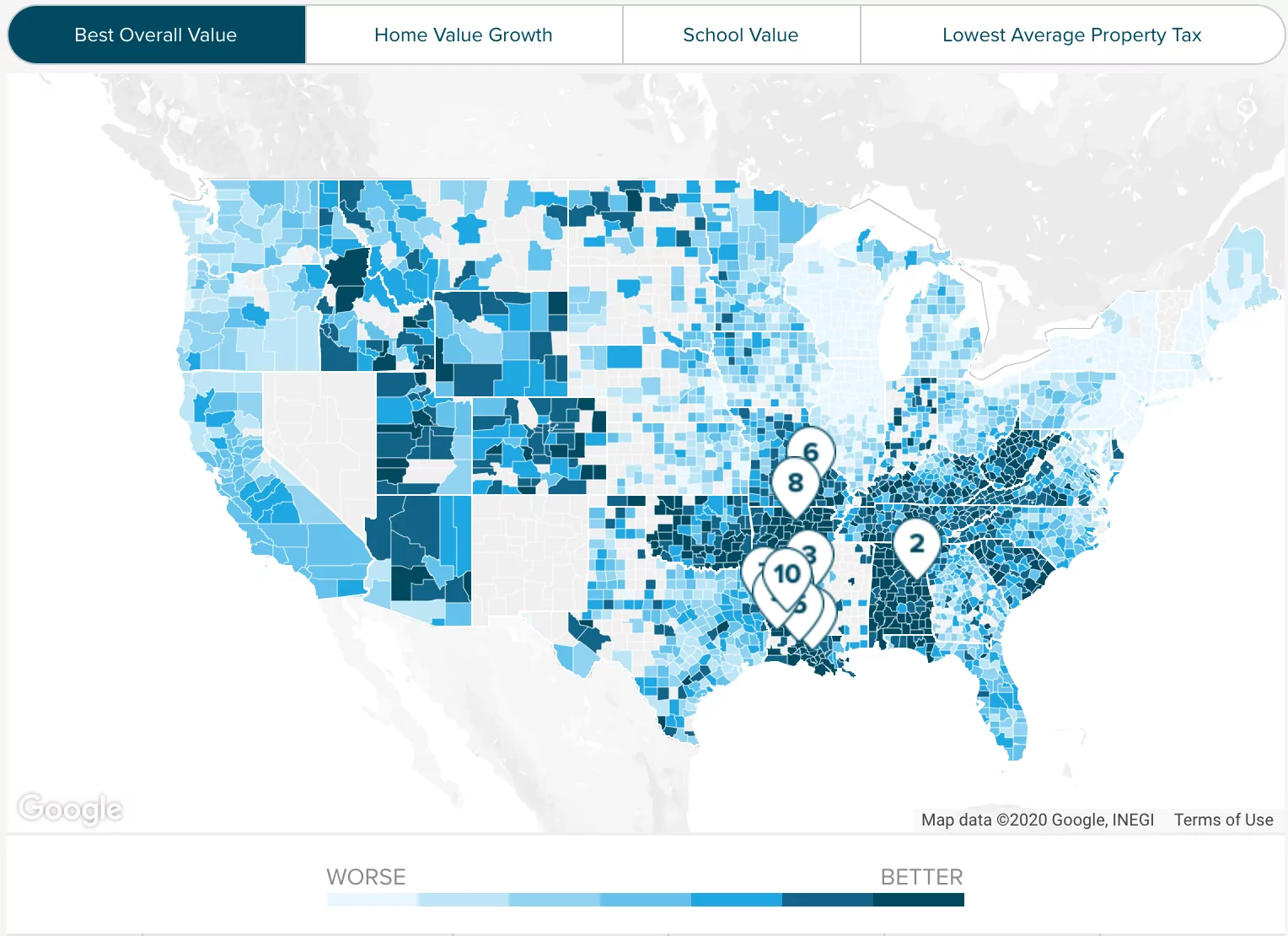

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Understanding California S Sales Tax

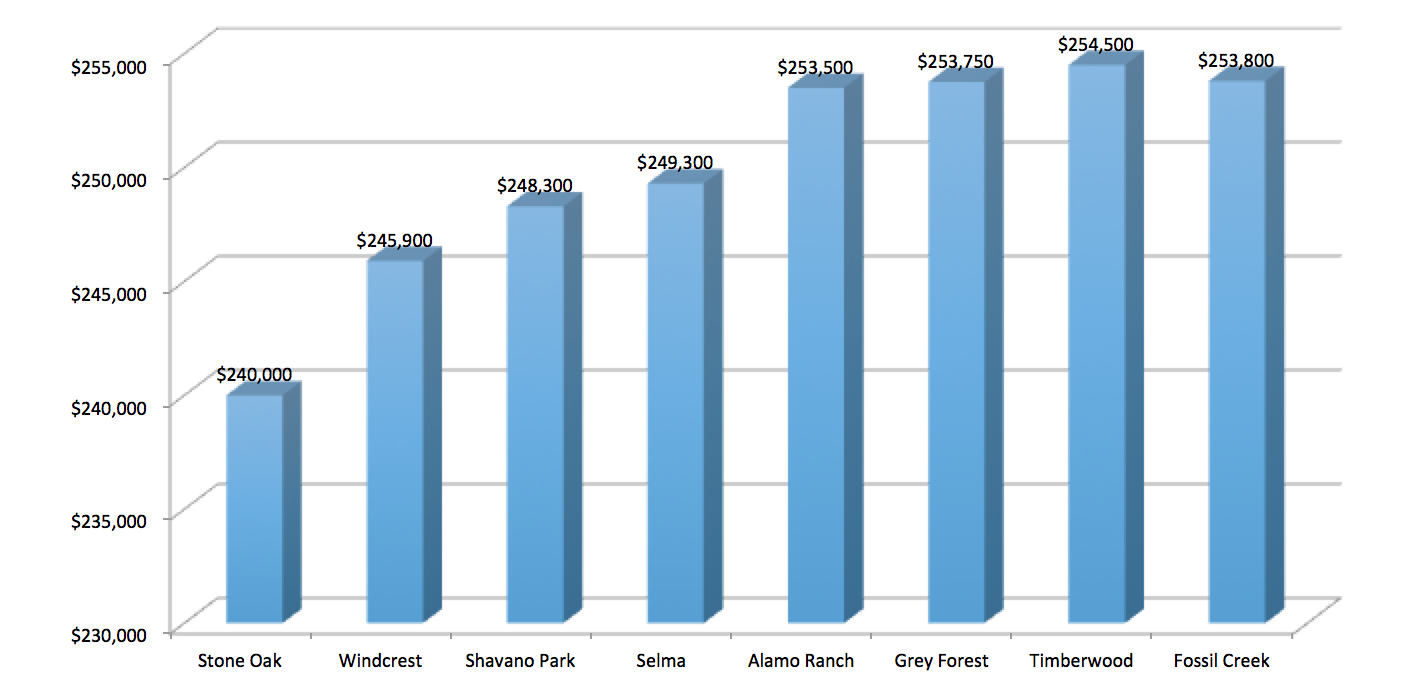

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

Tax Rates Bexar County Tx Official Website

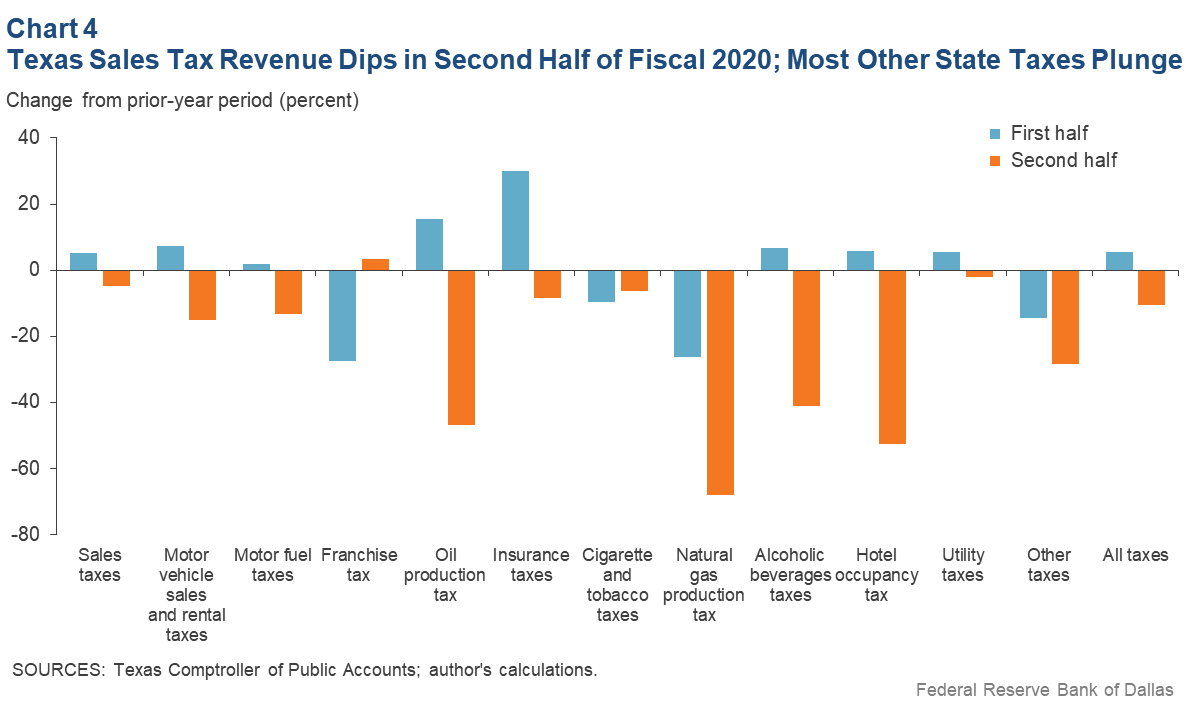

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

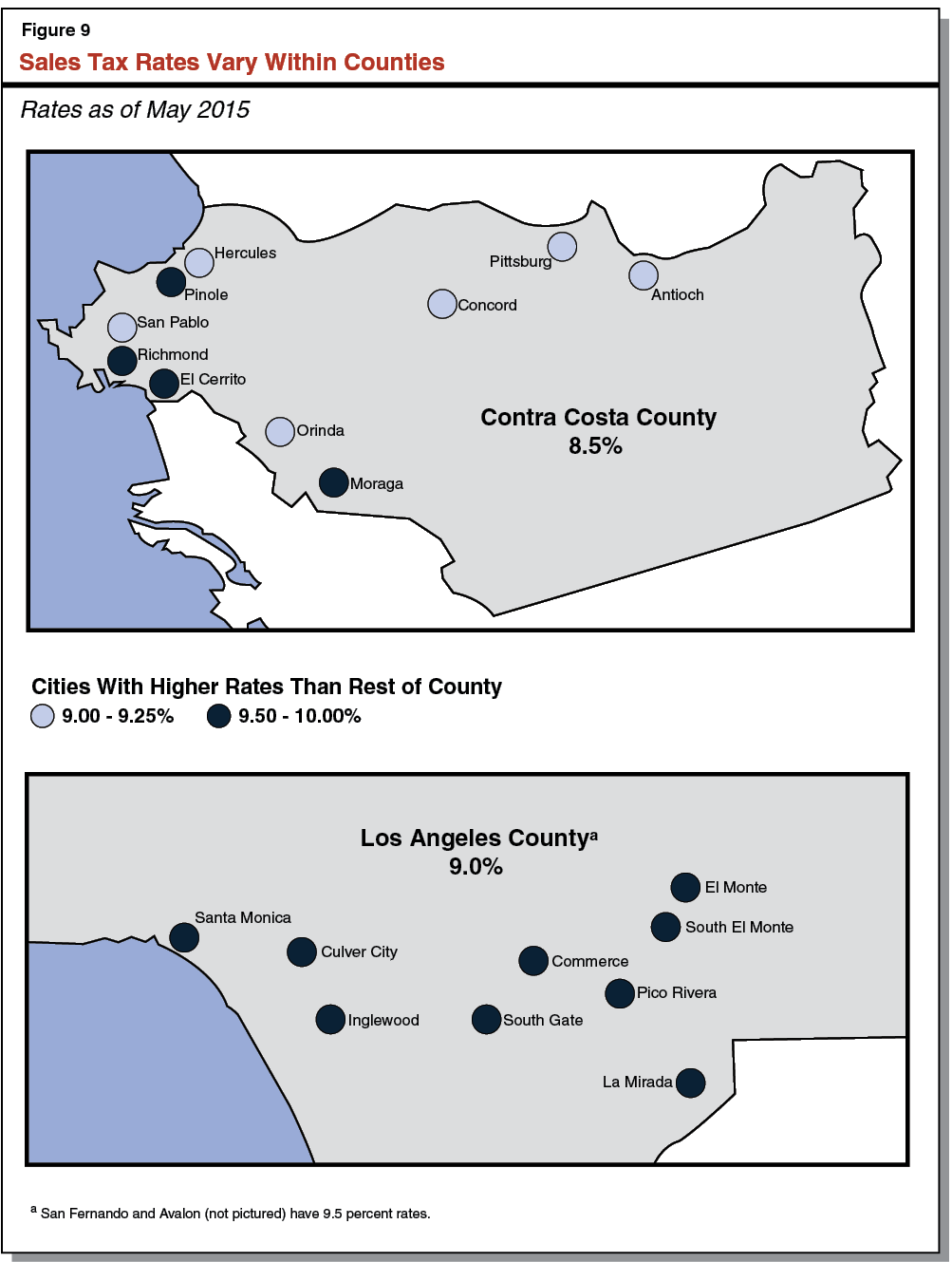

Understanding Tax Rate Discrepancies

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Understanding California S Sales Tax

Sales Tax By State Is Saas Taxable Taxjar

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Texas Sales Tax Guide For Businesses

Understanding California S Sales Tax

Understanding Tax Rate Discrepancies

Understanding California S Sales Tax

Tarrant County Tx Property Tax Calculator Smartasset

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption