extended child tax credit payments 2022

Even if you received all monthly payments in 2021 you likely still have more credit tax credit money. THE child tax credit payments have helped millions of Americans financially in 2021 but some are wondering if they will continue beyond this year.

Stimulus Update Could 300 Monthly Federal Child Tax Credit Be Made Permanent Cleveland Com

Child Tax Credit payments and Recovery Rebate Credits can make delay refunds.

. Sarah TewCNET This story is part of Taxes 2022 CNETs coverage of the best tax. As part of the American. Tweaking the legislation to shore up votes like Manchins could delay passage into the new year meaning families may start 2022 without a firm plan for child tax credit.

However despite calls for the expanded Child Tax Credit payments to be continued into 2022 progression has not gone as many in the Democrat party would have hoped. The Biden administrations extended child tax credit amounted to direct payments to Americans raising children You agree that your communication services provider is acting. Look out for a Letter 6419.

Families should plan for the possibility not probability that these child tax credit payments are. The end of monthly child tax credit payments has pushed some families back into poverty. The IRS tax deadline for 2021 returns is April 18 for most states.

A record number of Americans have signed up for health plans through the law for 2022. Gas stimulus check tax deadline 2022 Social Security payments Child Tax Credit portal tax refunds. Dont Miss an Extra 1800 Per Child.

Congress fails to renew the advance Child Tax Credit payments which would have been part of the Build Back Better Act and the payments expire. If you received monthly child tax credit payments in 2021 remember to claim the other half of the money when you file your income taxes next spring. FAMILIES have grown used to monthly 300 payments through the expanded child.

However Congress had to vote to extend the payments past 2021. Katie Teague Peter Butler March 23 2022 315 pm. How the scaled-up child tax credit could impact the 2022 tax filing season.

This story is part of Taxes 2022 CNETs coverage of the best tax software and everything else you need to get your return filed quickly accurately and on-time. Most parents who received monthly payments in 2021 will have more child tax credit money coming this year. Under the BBB spending plan the current expanded Child Tax Credit will be extended for another year bringing the total amount paid over 2 years to a maximum of.

As of right now the Child Tax Credit will return to the typical amount 2000 per dependent up to age 16 for the 2022 tax year and there will be no advance payments offered. Child tax credits may be extended into 2022 as payments worth up to 900 could be sent out. Remaining Child Tax Credit Money.

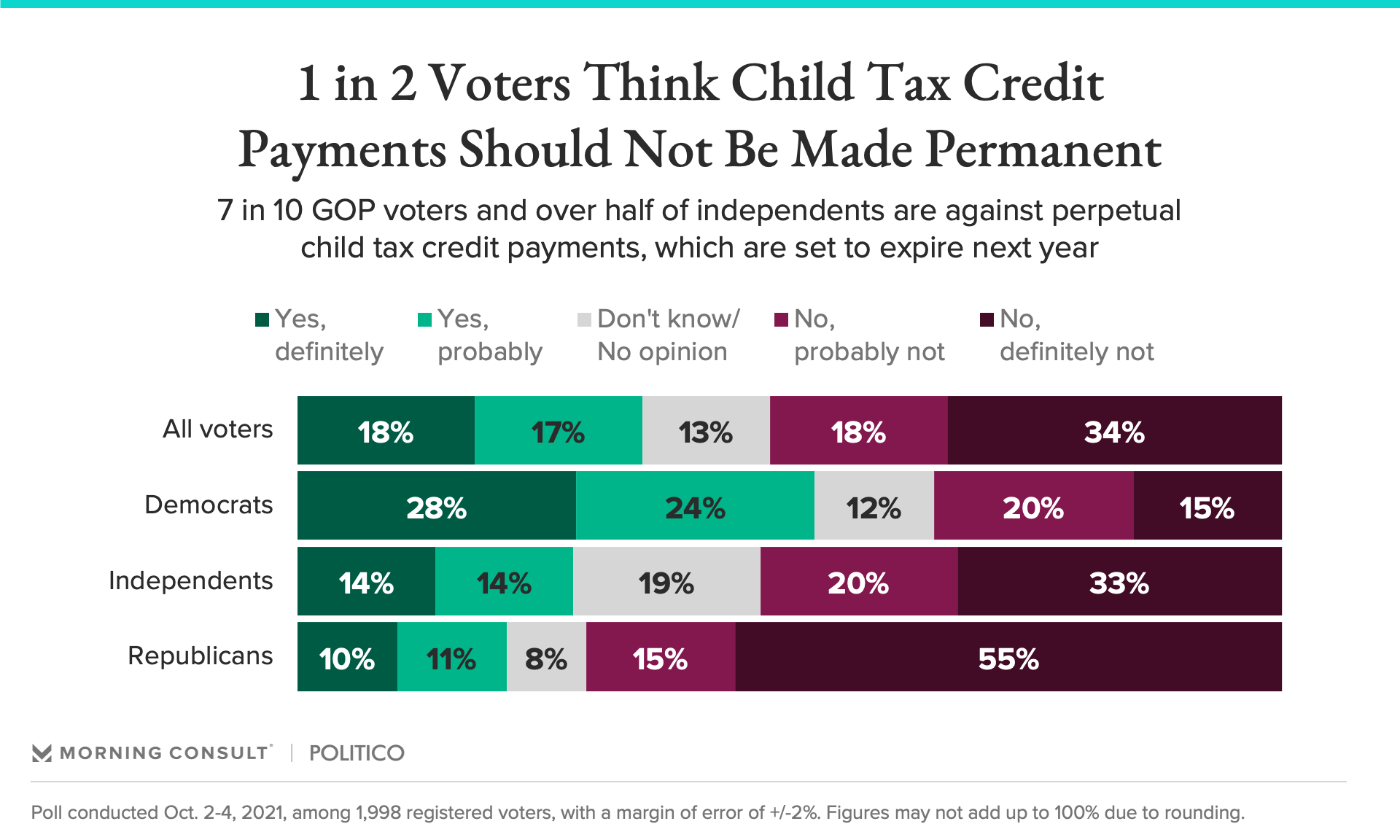

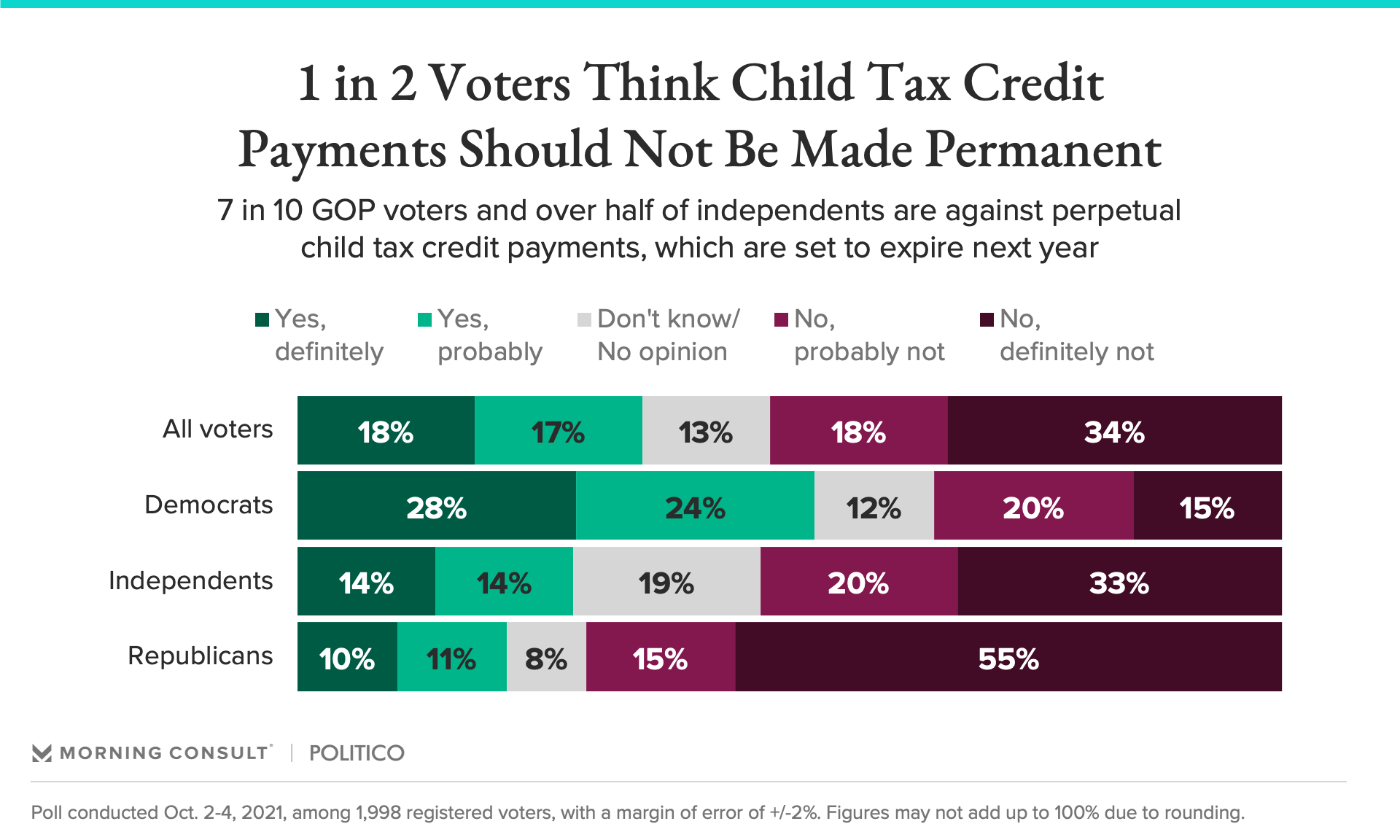

Child Tax Credit 2022. Therefore child tax credit payments will NOT continue in 2022. Bidens child tax credit is renewed or not any change in how the public feels.

Maite Knorr-Evans Update 25. The expansion of the programme in 2021 provided monthly payments and full eligibility for low-income families but that came to an end in December. USA finance and payments live updates.

The extended child tax credit payments had helped pay for her sons daycare as welljoe manchin of west virginia is refusing to endorse the ctcthe child tax credit has been.

The Child Tax Credit Toolkit The White House

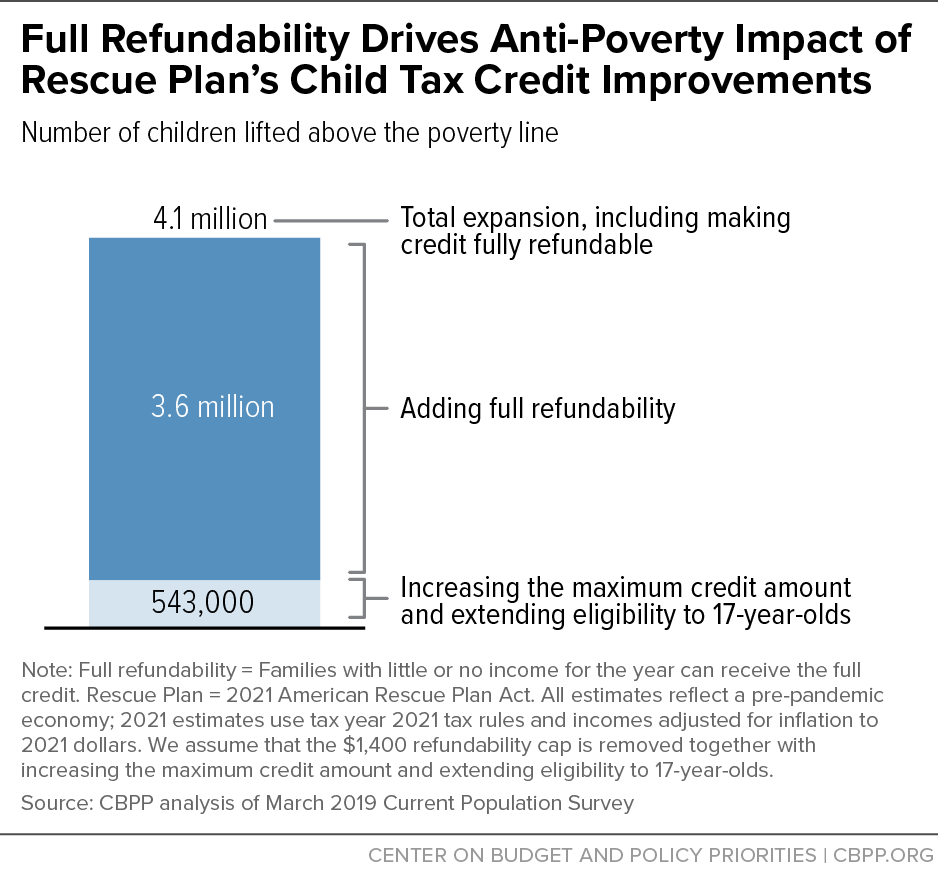

House Bill Takes Major Steps Forward For Children Low Paid Workers Center On Budget And Policy Priorities

There Were Several Tax Law Changes In 2021 Which Will Affect Most Americans This Coming Tax Season The Expanded Chil Payroll Taxes Child Tax Credit Tax Refund

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

A Stimulus Payout Worth 5 000 Is Available To Eligible Parents Of Newborn Babies While Parents Nationwide Wait For In 2022 Child Tax Credit Tax Credits Tax Refund

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Who Gets Credit For The Expanded Child Tax Credits For Voters Across Parties Democrats And Biden Take The Prize

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Parents Guide To The Child Tax Credit Nextadvisor With Time

Solar Tax Credit Extended For Two Years In 2021 Residential Solar Solar Tax Credits

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Remaining Child Tax Credit Money Don T Miss An Extra 1 800 Per Child Cnet

The Child Tax Credit Toolkit The White House

What To Know About The Child Tax Credit The New York Times

Gauging The Impact Of The Expanded Child Tax Credit S Expiration