dependent care fsa income limit

Married and filing separate. Healthcare and Limited Purpose FSA 2021 2022.

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Married and filing jointly or single parent.

. The American Rescue Plan Act of 2021 gives employers the option to increase the dependent care flexible spending account DCFSA reimbursable limit to 10500 5250 for married couples filing separate tax returns for the 2021 calendar year. The IRS released its accompanying guidance IRS Notice 2021-26 in May. Dependent Care FSA 2021 2022.

This alert addresses how to adopt the.

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Health Savings Account Human Resource Services

Explore Our Free Taxi Receipt Template Receipt Template Template Printable Receipt

If You Were Given A Choice To Get 1 Million Dollars Today Or 1 Penny Multiplied Everyday For 30 Days What Would You Choose Penny 10 Things 30 Day

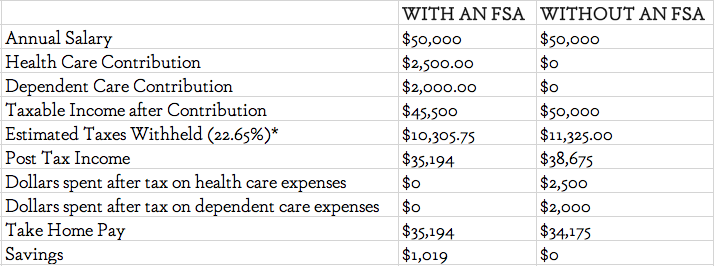

Lower Income Taxes With Dependent Care Flexible Spending Accounts Ketel Thorstenson Llp

Why Fsas Are Worth It Even For Low Income Earners

What Is A Dependent Care Fsa Wex Inc

Lower Income Taxes With Dependent Care Flexible Spending Accounts Ketel Thorstenson Llp

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Tx302 Payroll Withholding Tax Essentials Payroll Taxes Payroll Medical Insurance

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Get Our Example Of Silent Auction Receipt Template Silent Auction Bid Sheets Silent Auction Auction Bid

Lower Income Taxes With Dependent Care Flexible Spending Accounts Ketel Thorstenson Llp

Information About Flexible Spending Accounts Multnomah County

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning